Smart Climate Indices

Entelligent currently publishes two indices, the SCLMX and SCLMK. These indices reflect the performance of Entelligent’s financial approach, which leverages the predictive power of climate models to generate profitable market insights.

Design

The Smart Climate indices use machine learning to observe patterns and establish connections between predictive climate models and financial markets. We calculate each security’s sensitivity to disruptive climate scenarios, and then generate portfolios which are robust to variations in climate relative to the benchmark.

Sadly, I can’t give a much more detailed technical description than that without violating the intellectual property of Entelligent. A core component of the technological platform upon which the indices are built is a (heavily modified) form of Markowitz optimization, also known as mean-variance optimization. The library which underlies the index is written in Python. Scikit-learn, pandas, and cvxpy (a convex optimization library) are all used extensively.

10-Year Backtest

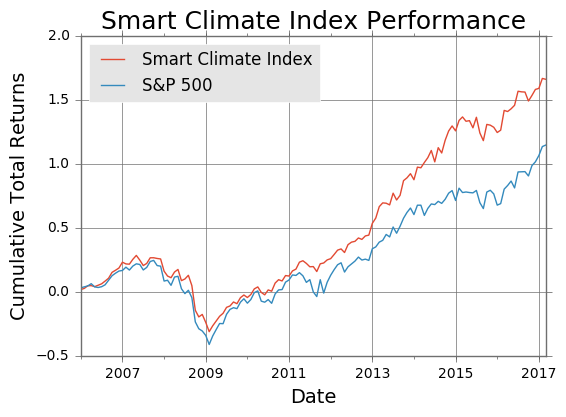

In order to test the efficacy of our approach, we have performed a ten-year backtest, using the S&P 500 as a benchmark. This portfolio has a maximum weight of 2.5% in any one security and does not turn over more than 15% of the whole portfolio on any given rebalance period. The portfolio is rebalanced quarterly, beginning in 2006 and running through the present.

The Smart Climate index is less volatile than the benchmark during the financial crisis of 2008, and shows higher performance as the market recovers and begins to thrive. Performance is particularly strong between 2013 and 2015. An initial investment of $10,000 in January 2006 would grow to over $26,000 if invested in a portfolio using the optimization techniques used by Smart Climate, over $5000 more than a comparable investment in an ETF that tracks the S&P 500.

Continuing Progress

Entelligent continues to develop and refine their methodology for portfolio optimization and index generation. The future of financial analysis must incorporate novel external data sources, if the analysis hopes to gain a competitive advantage in the market. The Smart Climate indices are available on Thompson Reuters and Bloomberg terminals, and are rebalanced quarterly.